Classic cars, making a sound investment

While everyone is talking about the economic situation and areconcerned with the stocks and shares, it seems the smart money has always been in classic or rare cars.

This has never been more relevant while in economic hardships seen in previous years or decades. Many investors compare classic or rare, limited production models of cars a good example of a sound investment to that of gold, although in many cases performing better than gold. As when prosperity comes back into play and investors in classic or rare cars sell a car from their portfolio, they can often stand to make a very tidy sum of money.

For example a used Ferrari Dino 246 GT in 1980 was worth around £9,000, where as currently examples are fetching over £150,000. Recently a 1972 246GT with only 30,000 miles sold for £164,300 at Bonhams Goodwood.

To learn more about investments classic and rare cars you can also check out the HAGI (Historic Automobile Group International) research organisation’s website or take a look on the Financial Times website as every month the HAGI Top Index is published.

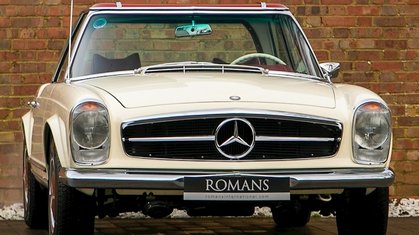

So, be sure you contact Romans International in Surrey, the Ferrari and luxury car specialist who will offer you unparalleled service and advice when looking your next luxury car.

/137/1/16203046156093e2e7ba3a1_romans-international-logo-black-23.05.png)

/137/1/162513748360dda14b60068_romans-international-logo-whiteout.png)